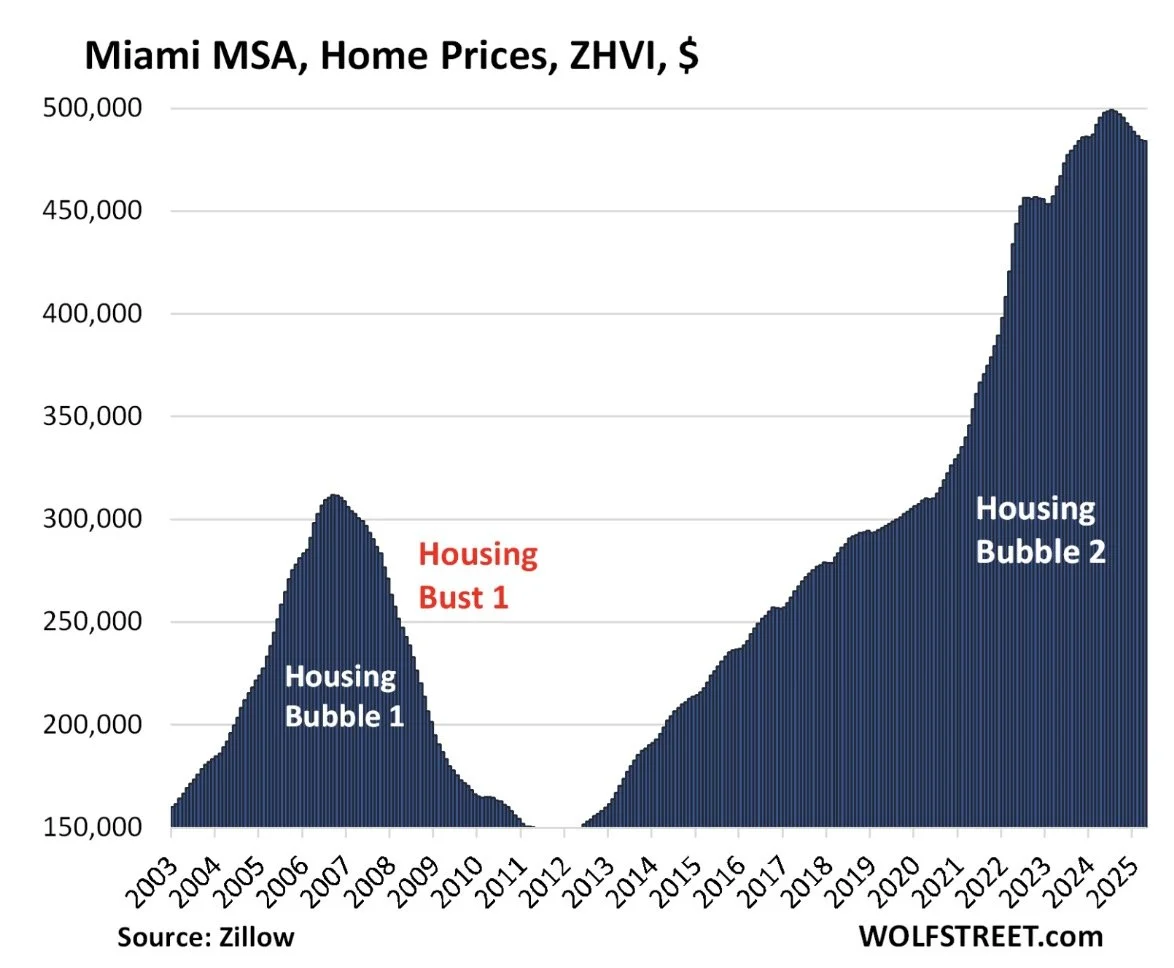

Housing Bubble 2.0?

/This is spring selling season when home prices in many markets rise sharply after declining during the winter, and they did so a year ago, and two years ago. But in April, prices of single-family mid-tier houses, condos, and co-ops across the US rose only 0.65% from the prior month, much less than in April 2024 (+1.15%) and in April 2023 (+1.34%). And in March, they rose only 0.21% from the prior month, much less than in March 2024 (+1.14%) and in March 2024 (+0.75%). A similar pattern played out in February.

This much smaller month-to-month price increase in April caused the year-over-year price gain in homes across the US to get whittled down to just 0.65%, continuing the trend of lower year-over-year gains. In the Miami metro, sales prices were actually down 2.3%.

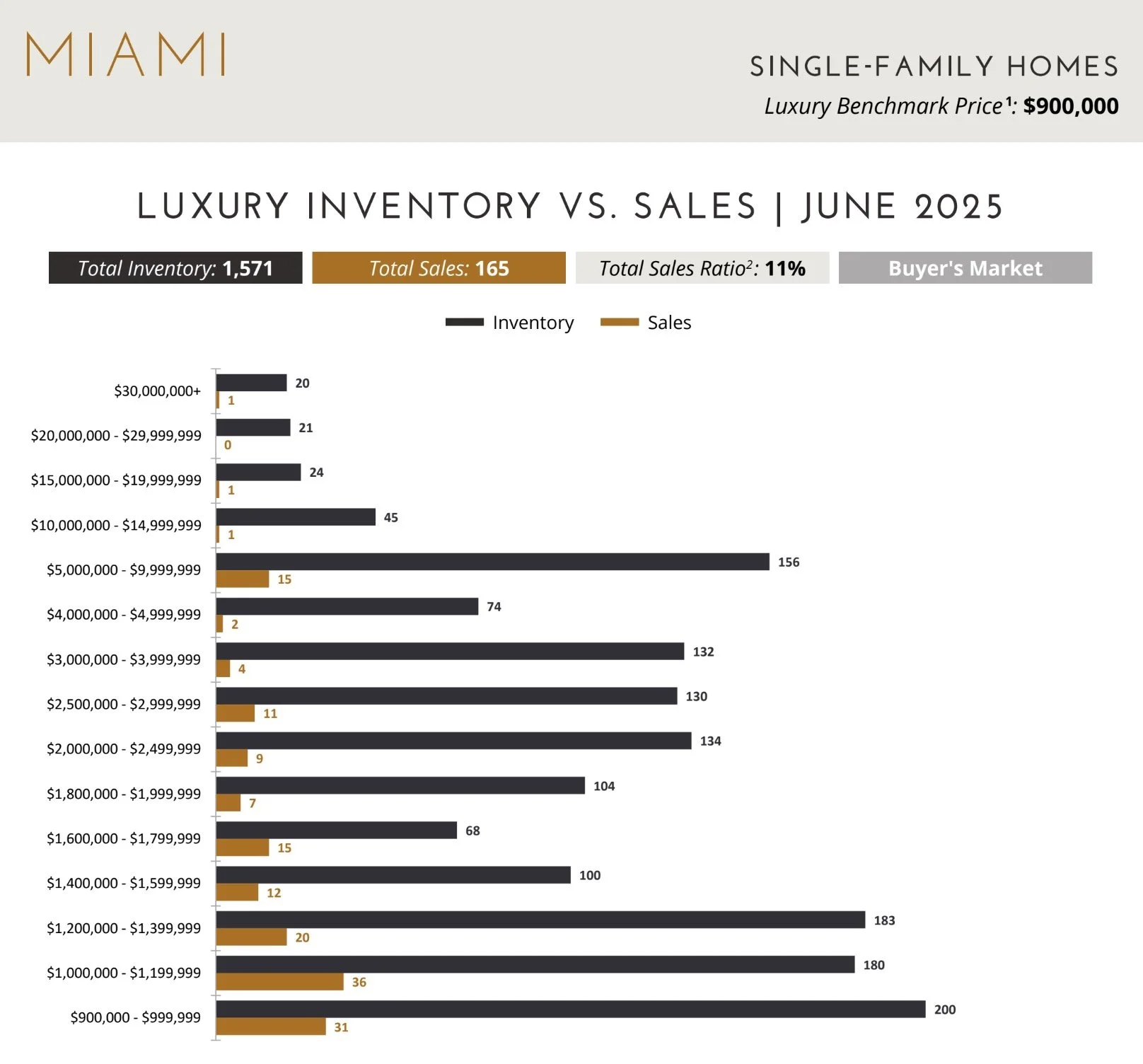

Even in the luxury markets (homes priced over $900,000) of the Miami metro, where cash deals happen more often, the market is slow. This is a bit surprising because with many of these deals happening in cash, interest rates are almost a non-factor. Velocity should be better than at the lower price tiers, but this is not the case.

As much as I’d like to see a balanced market, where the “regular” number of deals happen, I do not see that returning any time soon. In fact, I think we could see sales prices retreat 5% from here and still the velocity will remain slow.