Quick Hits on Important Home Buying/Selling Stuff

by Hal Feldman (MiamiHal.com) - updated December 14, 2023

The following topics are important to know about and are explained in short form. By no means should they be considered ‘fully knowledge’ of the topic. I am happy to discuss them in detail upon request, as my years of experience will certainly give you a leg up in making a smart move.

WINDSTORM INSURANCE

South Florida residents know all too well that windstorm damage can be devastating. One only needs to mention Hurricane Andrew in 1992 to evoke some pretty vivid memories. More recently, the 2004 and 2005 seasons were unprecedented in the frequency of hurricanes and damage they caused. With this in mind, it’s easy to see how imperative it is to calculate the cost of windstorm insurance into any real estate transaction.

When I moved to South Florida in 2004, I had some knowledge about windstorm insurance, but really didn’t know how it worked. Perhaps you are in a similar situation. Windstorm insurance (sometimes called hurricane insurance) protects the policyholder from the effects of wind and wind-borne debris. This article provides starting points to understanding the mechanics of windstorm insurance. As always, consult with a professional about your specific needs.

Since Hurricane Andrew, a lot has changed in windstorm insurance. Although it is still possible to get private windstorm insurance, the list of carriers continues to dwindle. As a result, in 2002, the State of Florida created Citizens Windstorm Insurance Corporation. Citizens is utilized as a ‘last resort’ choice when no other carrier will insure the property. Citizens is required by law to have rates that do not compete with those of Florida's private insurance companies. It calculates those rates by looking at the rates of the top 20 insurers in the state and makes sure its rates are higher. Therefore, it is strongly recommended you invest the time to call several carriers to see if you can get a policy written with them.

If you land with Citizens as your carrier (and most of you will), the next step in understanding the mechanics of windstorm insurance is to look at home construction and location. In most cases, homes east vs. west of US-1 carry very different premiums. Also, construction standards will pay a big role in discounts (called wind mitigation) you will receive from your insurance carrier. Building codes got much stronger in 1994 and again in 2004, so home built after those times are typically less expensive to insure for windstorm.

Happy Home Hunting!

Hal

FLOOD INSURANCE

One of the reasons South Florida is called a little slice of paradise is the area’s abundant water. You are never too far from the beautiful ocean, sparkling lake, canal or stream. However, sometimes we get too much of a good thing. Because Miami-Dade County is located in a unique geographical area, it is particularly susceptible to flooding from major rain events and storm surge.

With few exceptions, mortgaged homes in our region will require flood insurance. If not required, it is certainly strongly advised that any homeowner look into the hazards of potential flood waters and protect themselves accordingly.

When I moved from the Northeast to Miami in 2004, I had no idea about the importance of flood insurance. It was eye opening to understand how the risks were calculated, how a home was classified into a particular risk categories and how to best factor this information when selecting a home for purchase.

Most homeowners insurance policies do not cover flood damage. So, in 1968, Congress created the National Flood Insurance Program (NFIP) to help provide a means for property owners to financially protect themselves. In order to participate in the NFIP, your community must comply with FEMA standards to reduce the risks of flooding. Don’t worry, nearly every South Florida community is qualified to participate in the NFIP. To get started, work with your homeowners insurance company. They will provide information to help you obtain a flood insurance policy. Pricing varies on the coverage as well as risk.

FEMA designates risk levels (available here) by looking at elevation and proximity to water. They then assign each parcel of land a letter designation. Depending on your home’s letter designation, you will either be required to, or have the guaranteed option to, purchase insurance.

Miami-Dade County has a great website that you can use to plug in the address of any property in the County to check its flood zone designation. I highly recommend it when you are house hunting. You can also call the Miami‑Dade County's Flood Zone Hotline at (786) 315‑2847 to confirm your exact flood zone designation. As you hone in on a home that you like, take a few moments to understand the flood risks associated with the property. A little knowledge goes a long way.

Miami-Dade County continues to work with FEMA to reduce flood risks. Because of drainage improvements funded through the Miami‑Dade Stormwater Utility, and other enhancements to the community services provided by Miami‑Dade County, effective October 1, 2003 a 25% discount is included in the rate to those residents in unincorporated Miami-Dade who are in a flood zone and purchase flood insurance policies. A 10% discount is also available for those outside of flood zones, with the exception of Preferred Risk policies.

In late 2011, Miami-Dade County added an online storm-surge calculator. I feel it is a bit over-the-top, but it is still a useful tool to educate yourself.

Happy Home Hunting!

Hal

THE BENEFITS OF A PRE-APPROVAL LETTER

Pre-approval, as opposed to pre-qualification, signifies that the loan application has been taken through a rigorous procedure. Here's why pre-approval buyers are ahead in the home buying game:

Pre-approval saves time spent looking at houses you can't afford.

Most sellers will reject your offer without a pre-approval letter being attached.

A pre-approval letter with a DU report from a lender gives you an edge when multiple offers have been made on a house.

If you make an offer on a home and then apply for a loan, you are at the lender's mercy, who is aware that you do not have time to shop around. The pre-approval letter serves as an introduction well before business gets done.

Besides that, most Realtors® won't work with you until you are pre-approved for a home purchase. If you need help getting your pre-approval, I'm ready and able to point you in the right direction. In fact, my wife will likely be the one who can do this for you. Most importantly, pre-approvals do not create ANY liability or responsibility on your part.

Happy Home Hunting!

Hal

TERMITES

Termites can be anywhere in the United States. Being the sub-tropics, South Miami tends to have more than its share of these little buggers; however, we also have homes built primarily from concrete block. This lowers the potential for catastrophic damage, but the termite threat still warrants homeowners' attention.

I use a nationally-recognized firm to protect my house from termites. In 2006, we discovered termites in our attic and had to have the house tented. Afterwards, we were offered an annual warranty. By paying an annual fee, the company will perform an inspection each year and cover whatever costs are involved to kill off the termites and repair any of the damage done.

At approximately $400 a year, I think it is a great insurance policy. Seeing as how termite tenting a house my size can cost nearly $5000, it seemed like a fair deal.

Here are some great facts I learned "on the job" about these creatures:

You, and not the experts, are most likely to know if you have termites. Look around window sills, door jambs and any attic access points.

Termites are most active after 6pm! They like it when it's cooing down, so if you're going to look for active termites search after 6pm.

Termites die when temperatures reach 115 degrees. That's why, if they are in an attic, they tend to stay in the insulation, near pipes, or near air conditioning vents.

Termites do like light, so they also will tend to eat their way to a light source. This might be to your ceiling (from the attic) or to the outside eves of your home.

Staying with keeping cool, termites like cool wood. If they had a choice between your attic or a beautiful dining room table, you'd bet they'd be eating at the table.

Regular termites swarm and breed May-August. Subterranean termites are most prevalent December-May.

There is a saying here in South Florida. There are three types of homes here. Homes that had termites, homes with termites and homes that will have termites. This is nothing to be afraid of. You just need to know how to handle things.

I hope I've educated you a bit and didn't creep you out!

Happy Home Hunting!

Hal

THE BIG 3: ROOFS, PLUMBING AND SEPTIC

You must pay attention to three big potential gotchas with buying and selling homes in South Florida. As a seller, these are the items most likely to trip you up when a buyer goes to get financing. For the buyer, these items will either become an issue during inspection or later when they go to try to insure the property.

ROOFS

Since we are approximately 32 years since Hurricane Andrew, many of the roofs installed in the aftermath are at the end of their usable life. While it may not be leaking now, if you've been crossing your fingers seeing if you can sell before the inevitable occurs, you may be fooling yourself.

Even if the roof doesn’t leak, you may not be in the clear. When an inspection company comes, they will estimate useful life remaining. Unless it is more than 4 years, there may be no insurance options for your buyer which, in turn, means no financing. I know some ways to mitigate this issue, but it is far better to avoid it in the first place.

The best thing you can do is find a reputable roofer before you list the home and ask them for an inspection. They'll be looking for business. You'll be looking to get their report for other reasons.

I always get asked about types of roofs and their value on a house. In short, metal roofs are the longest lasting. Right behind that is concrete tiles. However, as of late, shingle technology has narrowed the gap. Some shingle roofs have a 35 year guarantee. But I defy anyone to make a claim at that time. :)

Read much more about roofs below (see A Deeper Dive of Roofing and Insurance)

PLUMBING

There are two categories of piping in a home, supply lines and waste lines.

The pipes supplying fresh water can be galvanized, copper or a form of PVC. Each have their pros and cons. Any incorrectly installed or damaged/leaking pipes can stop insurability. In most cases, it is not fresh water pipe issues that come up during inspections.

The bigger potential problem these days is cast-iron waste lines. Certain manufactured cast-iron has proven to react poorly to the rich limestone of South Florida and essentially rusts away. Since most of us don’t pay attention where the water goes after it goes down the drain, cast-iron pipe problems are literally buried and are often not discovered until you are in contract.

Cast iron was the predominant pipe used for residential waste water installations until 1974. The “bad” cast-iron that fails most often was typically manufactured between 1966-1973. If you have a home built in this era, be aware this is a highly likely place for problems to arise.

The reason why failed cast-iron pipe is such a problem is that under most situations, the only solution is to cut through your home's foundation (slab) to replace the pipes with PVC. This is an expensive proposition. Therefore, many insurance companies are starting to balk at writing new policies for homes with cast-iron pipes more than 25 years old, even if the pipes test and look good.

As a seller, the only thing you can do to test for this in advance is to call a plumber who specializes in cast-iron and have him camera scope your system to determine if you have a problem. HOWEVER, here's the rub. Sellers may not want to do this because once they know there is a problem, they must disclose this to potential buyers. Consult your Realtor on how to handle this.

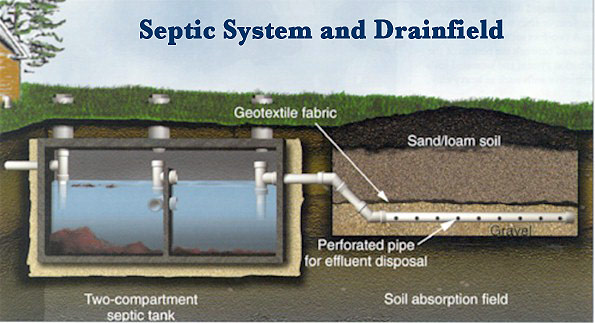

SEPTIC SYSTEM

...which leads us to septic systems. Although most inspections do not thoroughly check the septic system, some insurance companies will require it. Just like roofs and cast-iron pipes, septic systems have a finite life and many are pushing the limits right now. You can always add on a septic system inspection. Ask me for more details, as each home carries a unique set of circumstances.

This is dirty business and if both the septic tank and drain-field fail, you can be staring at a $15,000+ bill. It's no wonder that if the buyer's inspector or insurance company find a problem, you will likely be back at the negotiation table to make it to closing.

I hope I've educated you a bit and not worried you too much!

Happy Home Hunting!

Hal

A DEEPER DIVE ON ROOFING AND INSURANCE

Hurricane Andrew ripped through South Florida on August 24, 1992. Its impact was devastating and still being felt today. Sure, the trees and vegetation have recovered. In fact, virtually all facets of the area have been restored, but the mental impact will leave us forever changed.

Among the effects of Hurricane Andrew, many roofs were either destroyed or sustained significant damage. Although the pre-Andrew South Florida Building Code, which included Dade and Broward counties, had been considered one of the best in the country, those standards were not adequately enforced because “that tended to slow down construction and raise costs.” All that changed after Andrew. Florida took Andrew as a true lesson learned.

In 1994, the Florida Building Code included significant changes to the roofing code. While there are a lot of technical changes, the average homebuyer need only know that if a home was built in 1994 or later, there are significant savings in windstorm insurance rates. Of course, the home itself is more likely to withstand high winds without significant damage as well. This alone is a good reason to seek out a home built after 1993.

In 2004, the Florida Building Code was further updated and further improvements were made to roof and window/door code. Again, homes built after 2004 will yield further insurance rate credits and ensure the home is even more resistant to wind and weather conditions.

One more important facet of discussing roofs in South Florida is what I call the “Andrew Half-Life”. Many roofs were replaced in the recovery efforts from Andrew. Most were just putting down new plywood and shingle, tile or metal. A select few actually changed trusses and added reinforcement to the roof straps. Regardless, a lot of roofs were “new” in 1993 and 1994. Given the average life cycle of roofs, we see an approximate 20-year repetition. This can affect a home and its related maintenance costs in many ways.

As you seek out a home to purchase in South Florida, it is critical to understand what you are getting into. Sure, you have certain house features that will make that house a home for your family, but beyond the look and feel, the MiamiHal team is able to help you understand the hidden features that play a critical role in the enjoyment of your home.